Personal Loans Canada for Beginners

Personal Loans Canada for Beginners

Blog Article

All About Personal Loans Canada

Table of ContentsHow Personal Loans Canada can Save You Time, Stress, and Money.Unknown Facts About Personal Loans CanadaGetting The Personal Loans Canada To WorkHow Personal Loans Canada can Save You Time, Stress, and Money.See This Report about Personal Loans Canada

Settlement terms at the majority of personal car loan lending institutions range between one and 7 years. You receive every one of the funds simultaneously and can utilize them for almost any kind of function. Consumers typically utilize them to finance a possession, such as a vehicle or a boat, settle debt or assistance cover the price of a major cost, like a wedding celebration or a home remodelling.:max_bytes(150000):strip_icc()/pros-cons-personal-loans-vs-credit-cards-v1-4ae1318762804355a83094fcd43edb6a.png)

A set rate provides you the security of a foreseeable month-to-month payment, making it a prominent selection for consolidating variable rate credit rating cards. Payment timelines vary for individual financings, but consumers are frequently able to select payment terms between one and seven years.

How Personal Loans Canada can Save You Time, Stress, and Money.

The charge is typically subtracted from your funds when you settle your application, reducing the amount of cash you pocket. Personal finances rates are much more straight linked to short term prices like the prime rate.

You might be supplied a lower APR for a shorter term, due to the fact that loan providers understand your balance will be repaid quicker. They may bill a greater rate for longer terms recognizing the longer you have a financing, the more probable something could alter in your finances that might make the payment expensive.

An individual finance is likewise a great option to using charge card, considering that you obtain money at a fixed price with a precise payback day based upon the term you pick. Bear in mind: When the honeymoon is over, the regular monthly payments will be a tip of the cash you spent.

Personal Loans Canada - The Facts

Prior to taking on financial obligation, use an individual finance payment calculator to assist spending plan. Gathering quotes from several loan providers can aid you detect the most effective deal and potentially conserve you passion. Compare rate of interest, costs and lending institution track record before using for the loan. Your look here credit scores score is a large aspect in determining your eligibility for the financing along with the rates of interest.

Before applying, understand what your score is to make sure that you understand what to expect in regards to expenses. Be on the lookout for surprise charges and penalties by checking out the lender's terms and problems page so you do not finish up with less money than you need for your economic goals.

Personal car loans call for proof you have the credit scores account and earnings to settle them. Although they're simpler to get than home equity fundings or other protected loans, you still need to reveal the lender you have the methods to pay the finance back. Personal financings are better than bank card if you desire a set month-to-month repayment and require every one of your funds at as soon as.

An Unbiased View of Personal Loans Canada

Bank card may be far better if you require the adaptability to attract money as needed, pay it off and re-use it. Credit cards might likewise offer incentives or cash-back choices that individual finances don't. Inevitably, the finest credit history product for you will depend on your cash routines and what you require the funds for.

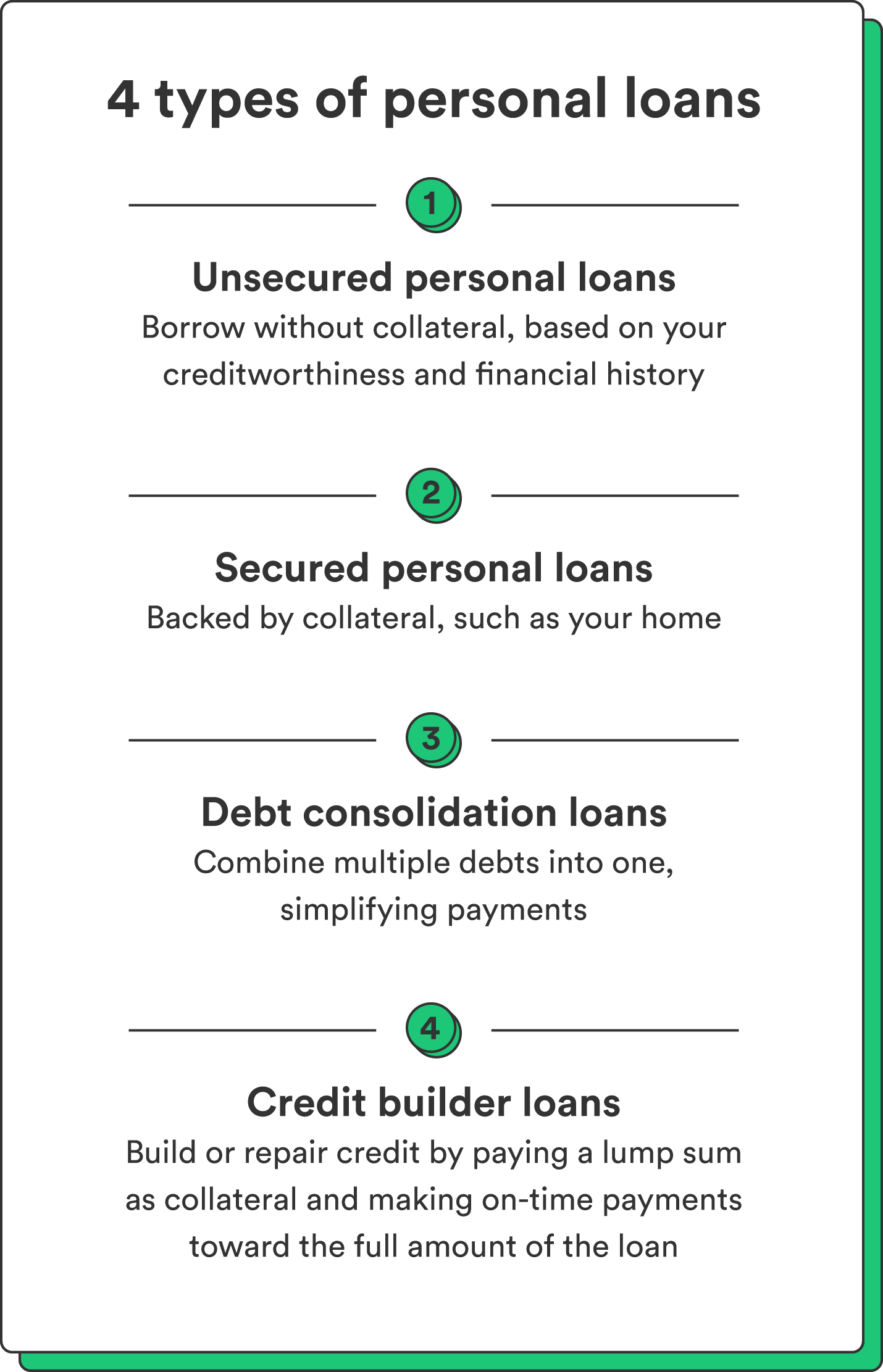

Some lending institutions may additionally charge costs for individual fundings. Individual fundings are car loans that can cover a number of personal expenditures. You can discover individual car loans via financial institutions, credit score have a peek at these guys unions, and online loan providers. Individual fundings can be secured, suggesting you need security to borrow cash, or unprotected, with no security needed.

As you invest, your offered credit is reduced. You can after that enhance readily available debt by making a repayment toward your credit limit. With an individual lending, there's typically a fixed end date by which the lending will be paid off. A personal line of credit history, on the various other hand, might stay open and readily available to you forever as lengthy as your account stays in great standing with your loan provider - Personal Loans Canada.

The cash gotten on the funding is not strained. Nonetheless, if the lending institution forgives the lending, it is thought about a canceled debt, which quantity can be exhausted. Personal fundings may be protected or unprotected. A secured individual financing calls for some type of collateral as a problem of loaning. You may protect a personal lending with cash possessions, such as a cost savings account or certificate of down payment (CD), or with a physical property, such as your vehicle or watercraft.

Getting My Personal Loans Canada To Work

An unprotected personal funding needs no security to borrow cash. Banks, credit history unions, and online lending institutions special info can provide both secured and unsafe individual car loans to qualified debtors. Financial institutions usually think about the last to be riskier than the former because there's no collateral to collect. That can mean paying a greater rate of interest for a personal funding.

Again, this can be a financial institution, cooperative credit union, or on-line personal loan lending institution. Typically, you would certainly first finish an application. The loan provider reviews it and determines whether to authorize or deny it. If accepted, you'll be provided the lending terms, which you can approve or decline. If you accept them, the next action is completing your lending documentation.

Report this page